san antonio local sales tax rate 2019

Local Governments Eminent Domain. Maintenance Operations MO and Debt Service.

The County sales tax rate is.

. 127 rows Sixteen cities with populations of 200000 or more do not impose local sales taxes though some have state sales taxes as high as 7 percent Fort Wayne and Indianapolis Indiana. Nineteen major cities now have combined rates of 9 percent or higher. Texas Comptroller of Public Accounts.

The Texas sales tax rate is currently. Did South Dakota v. Waco TX Sales Tax Rate.

There is no applicable county tax. Wichita Falls TX Sales Tax Rate. The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. City sales and use tax codes and rates.

The total local sales tax rate in any one particular location that is the sum of the rates levied by all local taxing authorities can never exceed 2 percent. The current sales tax rate in San Antonio Texas is 783 percent. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent.

8 hours agoTEXAS LAND FOR SALE 16. San Antonios current sales tax rate is 8250 and is distributed as follows. This rate includes any state county city and local.

Has impacted many state nexus laws and sales tax collection requirements. 2020 rates included for use while preparing your income tax deduction. 0125 dedicated to the City of San Antonio Ready to Work Program.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. Wayfair Inc affect Texas. 60 rows 2019 Official Tax Rates Exemptions Name Code Tax Rate 100 Homestead 65.

Northwest - 8407 Bandera Rd. 2019 GMC Sierra 1500 SLT 4x4 4WD Four Wheel Drive SKUKZ194823. San Antonio is in the following zip codes.

Tax Rates Calculator Exemption Certificates For Businesses Taxability Vehicles More San Antonio Florida Sales Tax Rate 2022 7 The San Antonio sales tax rate is 7 7 tax breakdown Sales tax region name. What is the sales tax rate in San Antonio Florida. The Florida sales tax rate is currently 6.

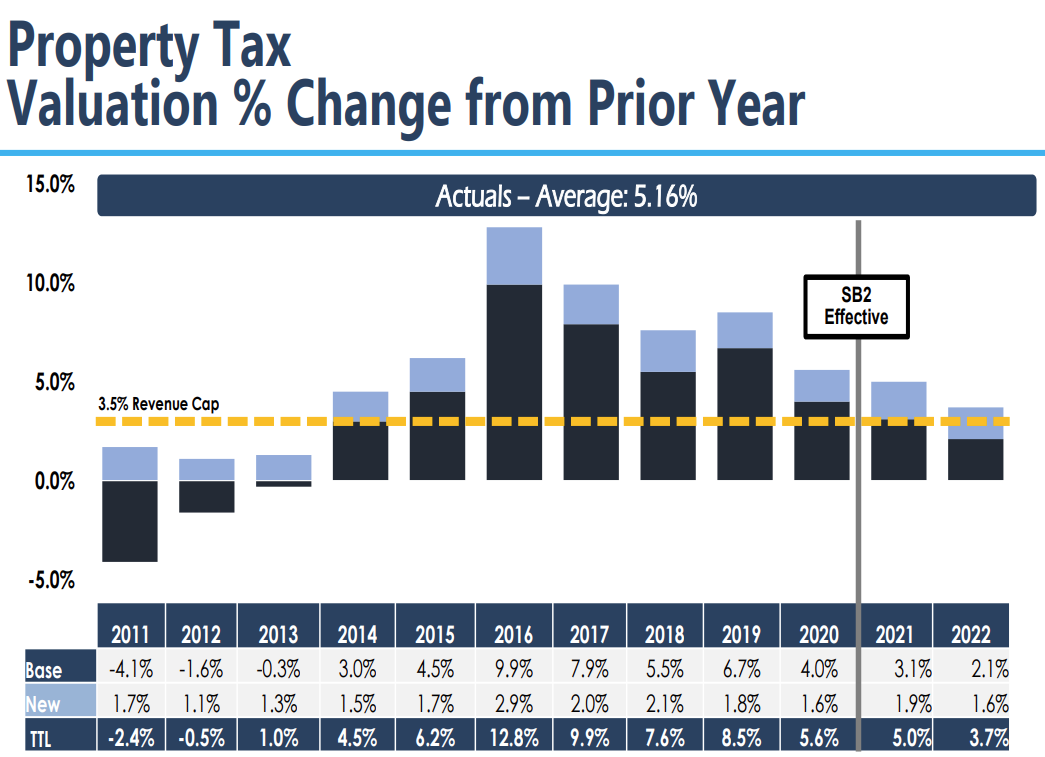

The latest sales tax rates for cities in Texas TX state. The property tax rate for the City of San Antonio consists of two components. Sales and Use Tax.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. 78201 78202 78203. Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate.

Individual Income Tax Rate. San Antonio Local Sales Tax Rate. The December 2018 total local sales tax rate was also 8250.

State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg. Bexar Co Es Dis No 12. Rates include state county and city taxes.

The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local. Tax rates last updated in February 2022. 2018 rates Zip code 78216 2019 sales tax fact 89 zip codes Special sales tax San antonio turned The latest sales tax rate for San Antonio TX.

Sales Tax Breakdown San Antonio Details San Antonio TX is in Bexar County. Counties in texas collect an. The combined area local code is used to distinguish areas where a portion of a city overlaps another taxing jurisdiction resulting in a total local tax rate that would exceed 2 percent.

It does a whole Fiesta Week. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. San Antonio TX Sales Tax Rate.

Up to 24 cash back San antonio texas sales tax rate 2019 San Antonio Texas knows how to party. California City and County Sales and Use Tax Rates Rates Effective 0701. Did South Dakota v.

Sales tax revenue collected by the state of texas in april totaled 258 billion a more than 9 drop compared to april 2019 according to a news release by the texas comptroller of public accounts. The minimum combined 2022 sales tax rate for San Antonio Florida is 7. The median rate for major cities is 8 percent.

California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government.

Contents Local sales taxes. The 2018 United States Supreme Court decision in South Dakota v. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

Always consult your local government tax offices for the. Sales Tax Rate Changes in Major Cities. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. Wichita Falls TX Sales Tax Rate. Wayfair Inc affect Florida.

This is the total of state county and city sales tax rates. San antonio free stuff. The San Antonio sales tax rate is 0.

The current total local sales tax rate in san antonio tx is 8250. Published on September 20 2019 by Youngers Creek. The Fiesta San Antonio.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The current total local sales tax rate in San Antonio TX is 8250. 6 for the first month.

The County sales tax rate is 1. 000 sat NE San Antonio Near. The December 2020 total local sales tax rate was also 8250.

Ad Lookup Sales Tax Rates For Free. There are 7184 active homes for sale in San Antonio TX which spend an average of 61 days on the market. The December 2018 total local sales tax rate was also 8250.

Lush garden event center in. 1000 City of San Antonio. The San Antonio sales tax rate is.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250.

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Which Texas Mega City Has Adopted The Highest Property Tax Rate

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Texas Sales Tax Guide For Businesses

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

Understanding California S Sales Tax

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Market Information Schertz Economic Development Corporation

Understanding California S Sales Tax

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

San Antonio Home Sales Surged In February 2015 San Antonio Real Estate Marketing Stats Real Estate Infographic

Do You Need To Know More About Forbearance And Mortgage Relief Options Keeping Current Matters Mortgage Investment Advice Real Estate Tips

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption